topic: 3

Expected Value in Trading: The Complete Guide to Thinking Like a Casino

The formula that separates professional traders from gamblers — and how to use it

topic: 3

topic: 3

The Video Breakdown

📺 Watch the visual explanation:

topic: 3

What Is Expected Value?

Expected Value (EV) is the average outcome of a decision repeated many times.

It answers the only question that matters in trading: If I make this exact decision 1,000 times, do I make money or lose money?

Not this trade. Not the next ten trades. The next thousand.

Expected Value strips away luck, emotion, and individual outcomes. It reveals the underlying mathematical structure of any repeated decision — and tells you whether time is on your side or working against you.

Casinos understand this. Insurance companies are built on it. Professional poker players live by it.

Most traders have never calculated theirs.

topic: 3

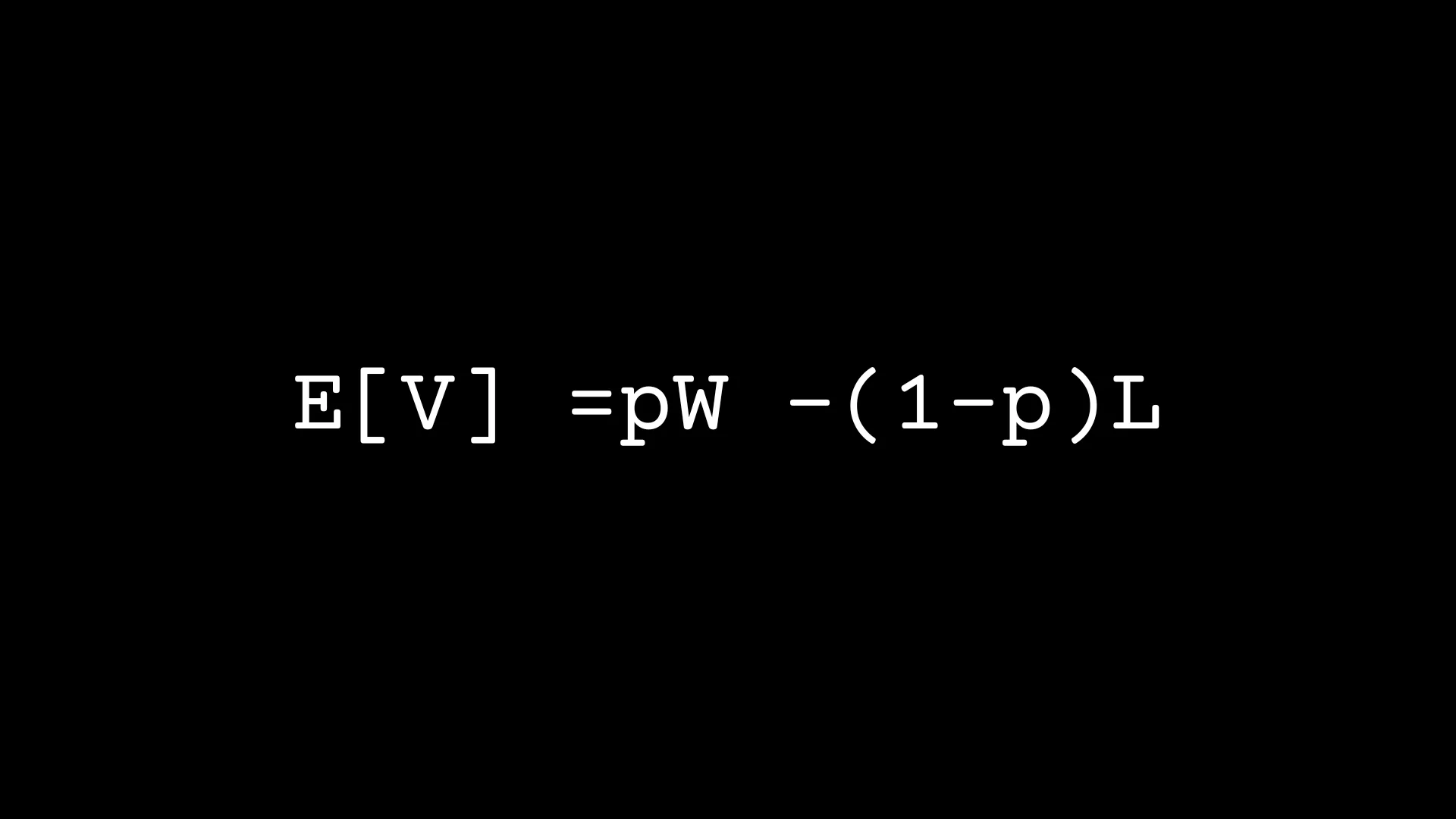

The Expected Value Formula

In plain terms:

EV = (Win Rate × Average Win) − (Loss Rate × Average Loss)

Where:

- Win Rate = percentage of trades that are profitable

- Average Win = mean profit on winning trades

- Average Loss = mean loss on losing trades

- Loss Rate = 1 − Win Rate

If EV is positive: You have an edge. Repeat the process, and profit becomes statistically inevitable.

If EV is negative: No amount of skill, discipline, or hope saves you. The math guarantees loss over time.

If EV is zero: You’re paying commissions to break even. Still a losing game.

topic: 3

Why Win Rate Is a Trap

Here’s where most traders destroy themselves.

Trader A: The “Winner”

- Win rate: 70%

- Average win: $100

- Average loss: $250

Calculation:

EV = (0.70 × $100) − (0.30 × $250)

EV = $70 − $75

EV = −$5 per trade

Trader A wins 7 out of 10 trades. Tells friends about the winning streak. Posts screenshots of green days.

But every trade costs $5 on average.

- Over 100 trades: −$500

- Over 1,000 trades: −$5,000

- Over 10,000 trades: −$50,000

The winning percentage is a trap.

topic: 3

Trader B: The “Grinder”

- Win rate: 35%

- Average win: $400

- Average loss: $100

Calculation:

EV = (0.35 × $400) − (0.65 × $100)

EV = $140 − $65

EV = +$75 per trade

Trader B loses almost twice as often as they win. Doubt creeps in after every losing streak. No exciting screenshots.

But every trade generates $75 on average.

- Over 100 trades: +$7,500

- Over 1,000 trades: +$75,000

- Over 10,000 trades: +$750,000

The paradox: The trader who loses more often builds wealth. The trader who wins more often goes broke.

This is why feelings lie and math reveals.

topic: 3

How Casinos Guarantee Profit

Walk into any casino. Watch the floor.

The gambler leans forward, pulse rising, focused entirely on the next card, the next spin, the next roll. His attention is compressed into a single moment — hoping, predicting, reacting.

Now look at the pit boss.

Calm. Detached. Watching the room, not the table. He doesn’t care who wins this hand. He knows the math. Over thousands of hands, the house edge guarantees profit.

The casino’s edge on blackjack is roughly 0.5%. Tiny. Almost invisible on a single hand.

But across millions of hands, that small edge compounds into guaranteed profit.

The casino doesn’t win because it’s lucky. It wins because:

- It has positive Expected Value on every game

- It has the patience to let sample size do its work

- It never deviates from its rules based on short-term outcomes

Individual outcomes are noise. The distribution is the signal.

topic: 3

The Gambler vs The House

This is the fundamental divide:

| The Gambler | The House |

|---|---|

| Chases outcomes | Controls the system |

| Acts on emotion | Acts on rules |

| Thinks in individual bets | Thinks in distributions |

| Bets randomly | Sizes risk with precision |

| Hopes | Knows |

One plays the game. One designs the game.

The question for every trader: Which one are you?

topic: 3

Why Most Traders Never See This

The human mind wasn’t built for probability. It was built for survival — quick pattern recognition, emotional response, immediate feedback loops.

When you win, dopamine rewards the behavior. When you lose, pain demands change. The brain optimizes for the feeling of winning, not the reality of compounding.

This creates three deadly patterns:

1. Outcome Obsession

Judging a system by the last trade, not the last hundred trades.

A profitable system can produce five losses in a row and still be mathematically sound. But most traders abandon it at loss three.

2. Win Rate Worship

Chasing strategies that win often, regardless of how much they win.

A 90% win rate with a 10:1 loss ratio is a slow bleed disguised as consistency.

3. Sample Size Blindness

Drawing conclusions from 10 trades. 20 trades. 50 trades.

The edge doesn’t stabilize until hundreds of executions. Everything before that is noise pretending to be signal.

The casino doesn’t flinch when someone wins $50,000 on a single night. They know the math. They know the sample size coming. They know time is on their side.

Traders flinch constantly — and destroy their edge in the process.

topic: 3

How to Think Like a Casino

The shift is not complicated. It’s just uncomfortable.

From Prediction to Probability

You don’t need to know what will happen on the next trade. You need to know what happens on average across the next 200 trades.

Prediction is arrogance. Probability is clarity.

From Outcome to Process

The outcome of any single trade is largely random. The process — entry criteria, exit rules, position sizing — is entirely within your control.

Control what you can. Release what you can’t.

From Feeling to Formula

When rules drive action, discipline feels lighter. You’re not fighting yourself on every decision.

The math is doing the emotional work.

From Player to Operator

Stop sitting at the table hoping. Start designing the table.

Define your edge. Quantify it. Execute without negotiation.

topic: 3

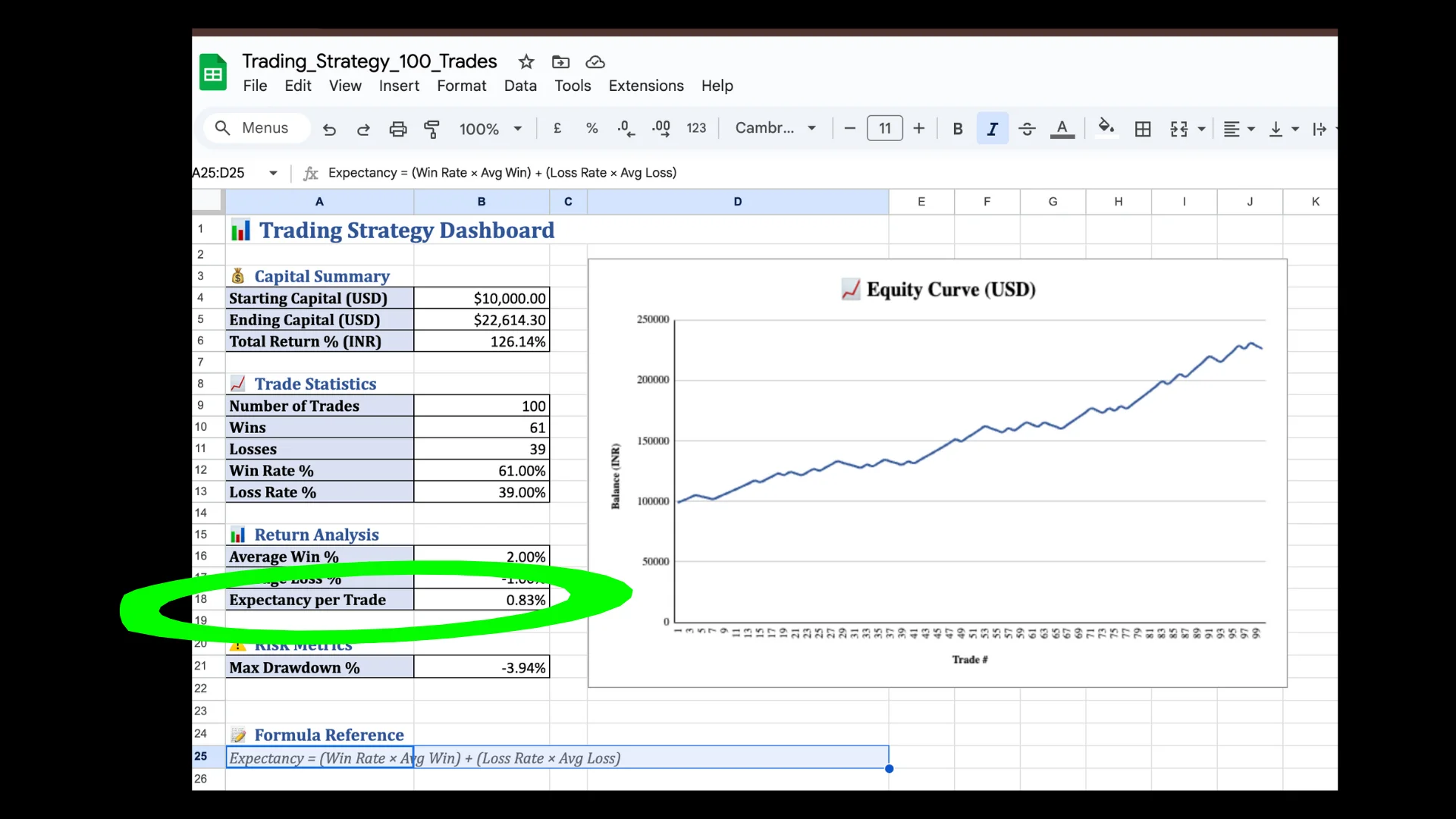

Practical Application

Here’s what changes when you internalize Expected Value:

You Stop Celebrating Wins

A win that followed your rules is just data. A win that broke your rules is a warning.

You Stop Mourning Losses

A loss that followed your rules is an operational cost — the price of playing the game. Expected. Budgeted. Irrelevant to your emotional state.

You Start Tracking Differently

Not just P&L. Track:

- Win rate

- Average win

- Average loss

- R-multiples

- Expectancy per trade

These numbers tell you whether you have an edge — or just a story you tell yourself.

You Size Risk With Precision

Position sizing is the lever. Same edge, different sizing, completely different outcomes.

The pit boss doesn’t bet randomly. Neither should you.

→ Related: Position Sizing: The Lever of Performance

You Think in Hundreds, Not Units

This trade doesn’t matter. The next hundred trades reveal the truth.

Zoom out. Let the distribution emerge.

topic: 3

Expected Value Beyond Trading

Expected Value isn’t just a trading concept. It’s a way of seeing decisions under uncertainty.

Every meaningful choice in life has a probability distribution attached to it:

- The job you take

- The relationships you invest in

- The skills you build

- The risks you accept

Most people optimize for the feeling of the next outcome.

Professionals optimize for the shape of the distribution over time.

Casinos understand this. Insurance companies understand this. Poker players understand this.

The edge isn’t in knowing more. It’s in thinking differently — in distributions instead of events, in process instead of outcomes, in math instead of hope.

topic: 3

The Takeaway

Small edges. Large sample sizes. Unshakable clarity.

That’s how the house always wins.

And that’s how traders grow — not by predicting better, but by designing systems where the math does the heavy lifting.

Stop playing the game.

Become the one running it.

topic: 3

Continue Learning

Related frameworks:

- Volatility Factor (coming next week)

- Position Sizing: The Lever of Performance

- Risk Management: The Only Edge You Control

topic: 3

Get Frameworks Like This Delivered

📧 Subscribe to the newsletter — systematic trading and decision-making frameworks, delivered weekly.

No fluff. Just clarity that compounds.

topic: 3

Think in odds. Act with discipline.

—

Clarity compounds — and so does attention given to the right ideas. Thank you for yours.

Intention → Knowledge → Action

— Ashim Nandi